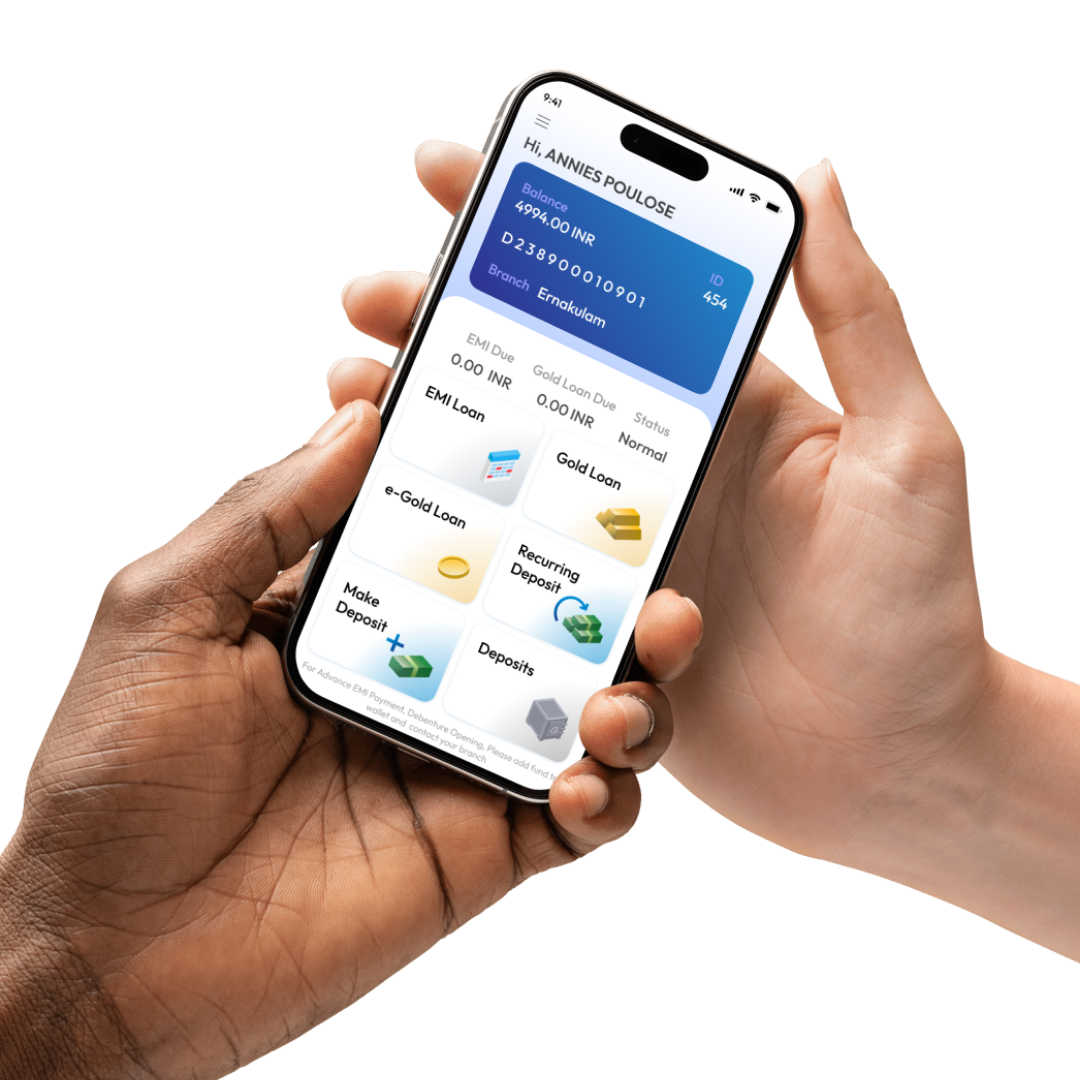

Transforming Banking for the Digital Generation

Crafting Tailor-Made Financial Solutions for Small Finance Banks, NBFCs, Nidhis, and Cooperative Societies.

Building the Future of Banking with

Our Clients

Core Offerings

Our AI-based end-to-end Banking Suite is designed to revolutionize how lending institutions operate. Combining advanced artificial intelligence with intuitive functionality, this solution empowers NBFCs, MFIs, and multi-state cooperative societies to streamline their processes, reduce operational costs, and deliver exceptional customer experiences.

Smart LOS

Achieve 100% paperless and fully automated loan origination for faster, error-free processing.

ALM

Leverage LLM models with built-in business intelligence for smarter decision-making and gain 360° control over ALM modules.

MIS

Powered by proprietary Digital Call Technology and an Analytical Engine, eliminating Excel redundancy and ensuring seamless data management.

Audit Module

Financial Audit Module tracks, records, and analyzes all core banking transactions with real-time insights for enhanced compliance. System Audit Module ensures end-to-end monitoring of system activities within the core banking solution.

Regulations & Compliances

Designed to meet all regulatory requirements set by the Reserve Bank of India. Automated Compliance Reporting generates reports aligned with RBI mandates for seamless submissions.

Paperless Lending

Fully automated loan origination and disbursement process empowers customers to fulfill their financial needs within minutes, making it incredibly swift and convenient.

eKYC, CKYC

The integration of Realtime CKYC with eKYC enables customers to onboard instantly, providing a seamless and efficient onboarding experience.

AI enabled Documentation Process

The integrated AI camera technology captures all the necessary KYC documents for loan origination, streamlining the process and ensuring accurate and efficient documentation.

Automation

Automating the entire workflow cuts financial institution operational costs upto 60%, boosting efficiency and optimizing resource allocation. Significant savings are achieved through reduced manual labor.

Your AI copilot,

Reimagine with AI.

Monitor. Manage. Mobilize

Transform workforce management with iBanker's Agentic AI. Automate HR tasks and monitor productivity effortlessly with an intelligent virtual workforce. iBanker delivers insights by analyzing employee audit trails, enhancing efficiency and performance.

Ask. Analyze. Act

Unlock seamless data interaction with iBanker, an AI-driven solution integrated with Coligo Core. Ask questions in plain language, and iBanker translates them into precise database queries, generating accurate reports. Revolutionize data exploration and decision-making with iBanker.

Capture. Verify. Streamline

Simplify loan origination with AI-powered camera technology that quickly captures KYC and loan documents. Lower costs, reduce human involvement, and improved TAT. AI-powered geo-fence exception reporting system that monitors and manages your field workforce efficiently.

Smart LOS

Seamless onboarding process with minimal TAT for Loan Approval

- Innovative eKYC Process

- 100% Paperless Solution

- Ensures 100% regulatory compliance

- Integrated cKYC solution

- eSign Ready

Self Servicing Kiosk

Streamline customer service with our intelligent self-servicing kiosk solution for faster turnaround and improved management.

- Face Recognition for Customer Login at Reception

- CKYC with Same-Day Turnaround (TAT) for New Customer Registrations

- QR based EMI Payment Options via UPI

- eKYC Enabled

- No Manual Loan Entry Collection at Reception

- Instant Access to Loan/Debenture Statements

- Improved Reports for Management on Customer Handling

Credit Decisioning System

Data scrubbing tool ensures data accuracy and integrity by cleaning and validating credit score data, enabling financial institutions to make reliable and informed decisions. Business Rule Engine (BRE) for customer underwriting, pre-approvals, cross-selling, and Early Warning Signals (EWS) management

- Data scrubbing tool for accuracy

- Data scrubbing tool for integrity

- Business Rule Engine for underwriting

- Early Warning Signals (EWS) management